|

|

|

-

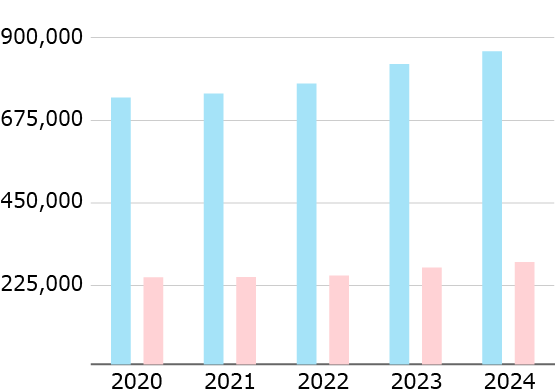

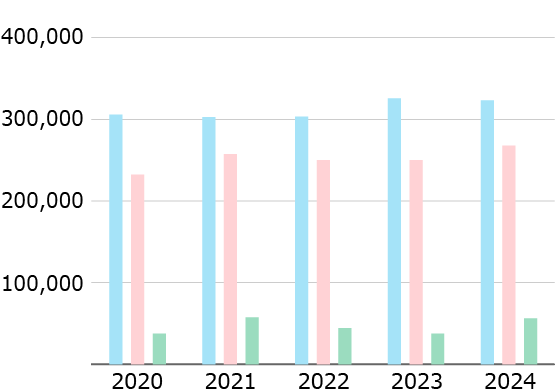

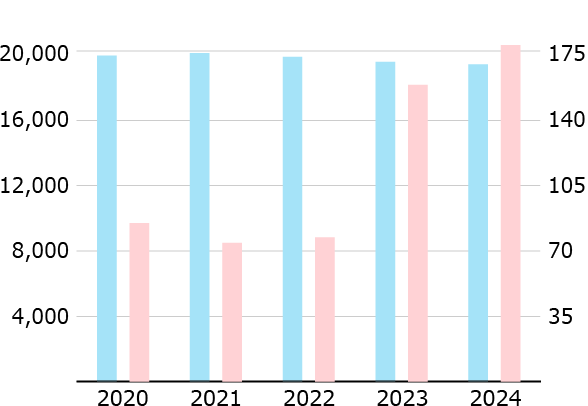

■Net

sales

■Gross

profit

(Millions of yen)

-

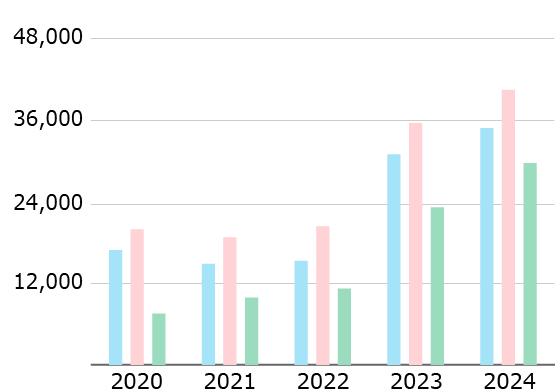

■Operating

income

■Ordinary

income

■Net income

(Millions of yen)

-

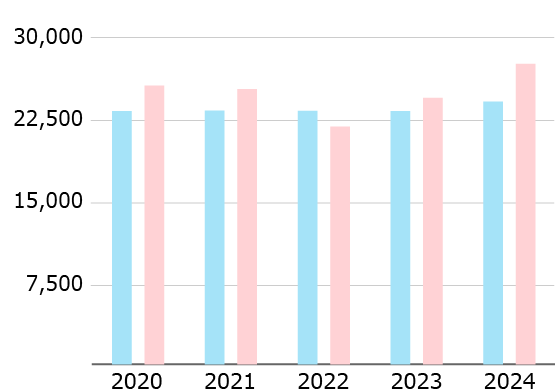

■Depreciation

and amortization

■Capital

investment

(Millions of yen)

-

■Total

stockholders'

equity

■Total

liabilities

■Interest-bearing

debt

(Millions of yen)

| |

2020 |

2021 |

2022 |

2023 |

2024 |

| Net sales

|

¥730,270 |

¥741,371 |

¥768,695 |

¥821,632 |

¥857,028 |

| Gross profit

|

238,036 |

239,062 |

242,681 |

264,660 |

279,657 |

| Operating

income |

16,734 |

14,750 |

15,169 |

30,710 |

34,554 |

| Ordinary

income |

19,775 |

18,622 |

20,233 |

35,295 |

40,129 |

| Net income

|

7,488 |

9,821 |

11,134 |

22,987 |

29,454 |

| Depreciation

and amortization |

23,112 |

23,143 |

23,130 |

23,110 |

23,967 |

| Capital

investment |

25,426 |

25,120 |

21,701 |

24,317 |

27,407 |

| Total

stockholders' equity |

303,789 |

300,811 |

301,239 |

323,456 |

321,172 |

| Total

liabilities |

230,721 |

255,663 |

248,344 |

248,583 |

266,051 |

|

Interest-bearing debt |

37,411 |

57,081 |

44,044 |

37,452 |

56,049 |

-

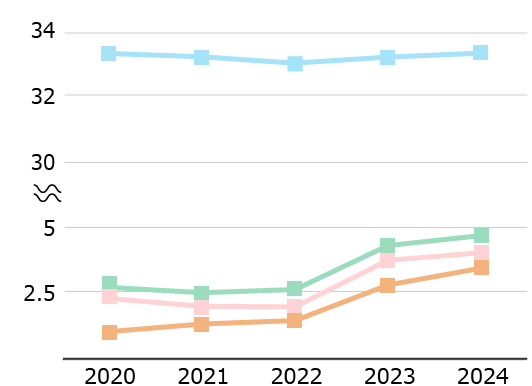

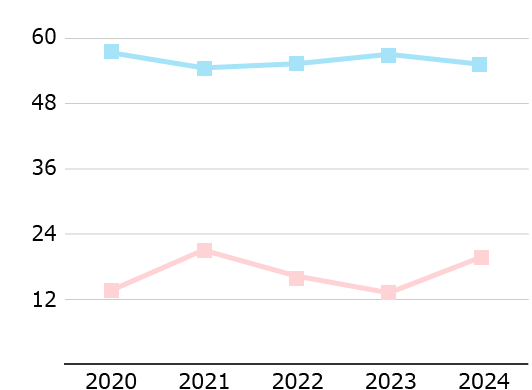

■Gross

profit margin

■Operating

margin

■Ordinary

income margin

■Net income

margin

(%)

-

■Return on

equity (ROE)

■Return on

assets (ROA)

(%)

-

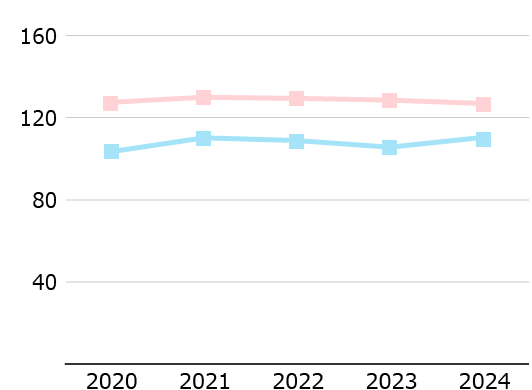

■Current

ratio

■Ratio of

total fixed assets to total stockholders' equity

(%)

-

■Equity

ratio

■Debt-to-equity

ratio

(%)

| |

2020 |

2021 |

2022 |

2023 |

2024 |

| Gross profit

margin |

32.60% |

32.25% |

31.57% |

32.21% |

32.63% |

| Operating

margin |

2.29 |

1.99 |

1.97 |

3.74 |

4.03 |

| Ordinary

income margin |

2.71 |

2.51 |

2.63 |

4.30 |

4.68 |

| Net income

margin |

1.03 |

1.32 |

1.45 |

2.80 |

3.44 |

| Return on

equity (ROE) (1) |

2.46 |

3.25 |

3.70 |

7.36 |

9.14 |

| Return on

assets (ROA) (2) |

1.39 |

1.80 |

2.01 |

4.10 |

5.08 |

| Current ratio

|

103.40 |

110.12 |

108.79 |

105.56 |

110.31 |

| Ratio of total

fixed assets to total stockholders'

equity |

127.42 |

129.86 |

129.31 |

128.48 |

126.82 |

| Equity ratio

|

56.84 |

54.06 |

54.81 |

56.54 |

54.69 |

| Debt-to-equity

ratio (3) |

13.41 |

20.80 |

16.08 |

13.01 |

19.56 |

-

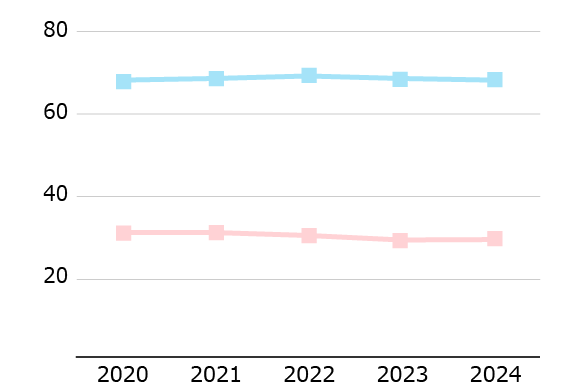

■Ratio of

cost of sales to net sales

■Ratio of

selling, general and

administrative

expenses to net sales

(%)

-

■Number of

employees

■Oparating

income per employee

(No.of

employees)

(Ten thouthand

of yen)

-

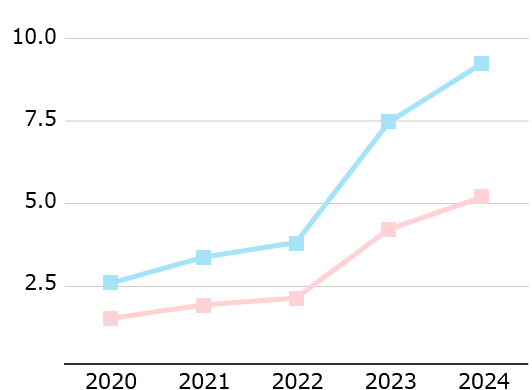

■Price-earnings

ratio

(Times)

-

■Price-book

value ratio

(Times)

(%, No. of

employees, Yen, Times)

| |

2020 |

2021 |

2022 |

2023 |

2024 |

| Ratio of cost

of sales to net sales(%) |

67.4% |

67.8% |

68.4% |

67.8% |

67.4% |

| Ratio of

selling, general and administrative

expenses to net sales(%) |

30.3 |

30.3 |

29.6 |

28.5 |

28.6 |

| Number of

employees |

19,832 |

19,985 |

19,750 |

19,446 |

19,291 |

| Oparating

income per employee(Yen) |

843,792 |

738,059 |

768,061 |

1,579,278 |

1,791,216 |

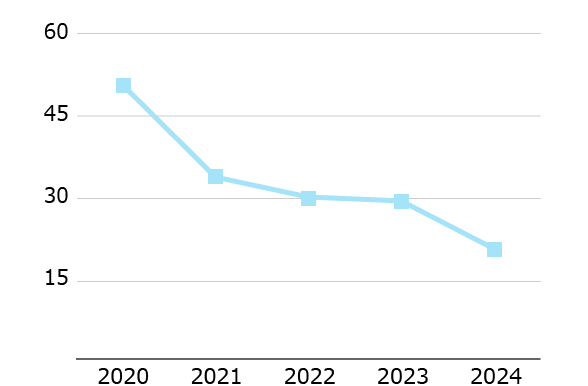

| Price-earnings

ratio (Times) |

50.05 |

33.22 |

29.58 |

28.87 |

20.15 |

| Price-book

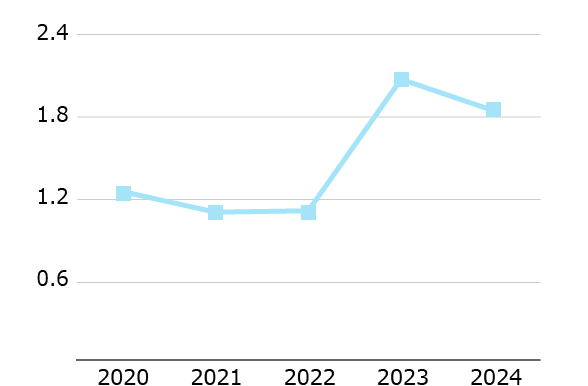

value ratio (Times) |

1.23 |

1.08 |

1.09 |

2.05 |

1.82 |

| |

2020 |

2021 |

2022 |

2023 |

2024 |

| Net income per

share(Yen) |

34.45 |

46.00 |

53.21 |

111.39 |

146.05 |

| Net assets per

share(Yen) |

1,397.43 |

1,413.35 |

1,443.86 |

1,570.53 |

1,614.89 |

| Cash dividends

per share(Yen) |

22.00 |

22.00 |

22.00 |

25.00 |

45.00 |

| Dividend

payout ratio(%) |

63.86% |

47.83% |

41.35% |

22.44% |

30.81% |

|

|

|

|