|

|

|

-

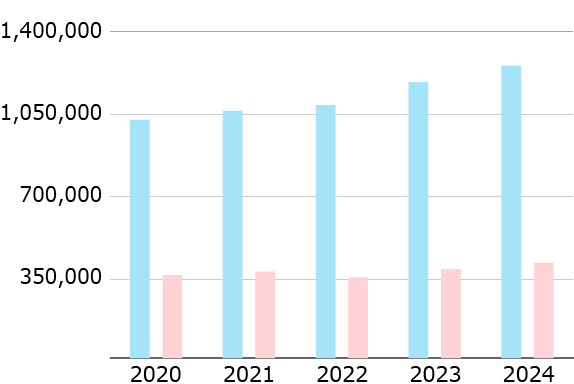

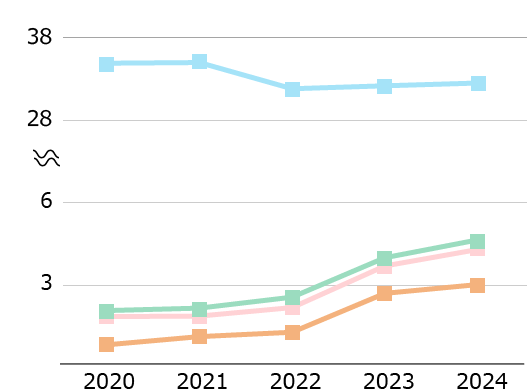

■Net

sales

■Gross

profit

(Millions of yen)

-

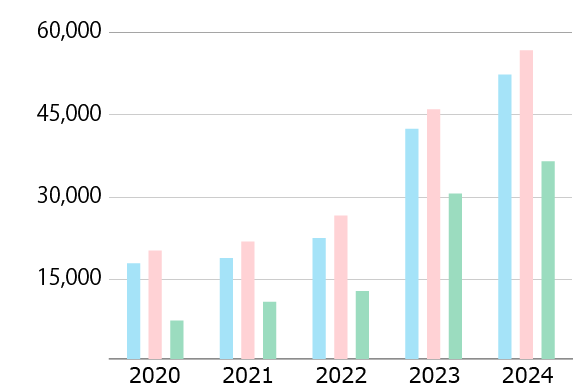

■Operating

income

■Ordinary

income

■Profit

attributable to owners of parent

(Millions of yen)

-

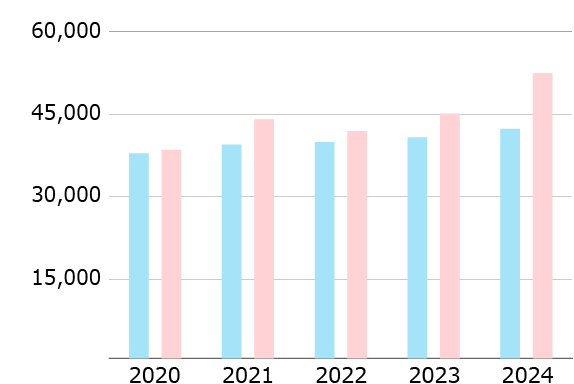

■Depreciation

and amortization

■Capital

investment

(Millions of yen)

-

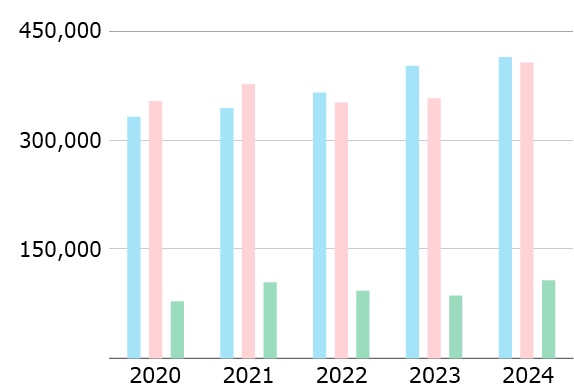

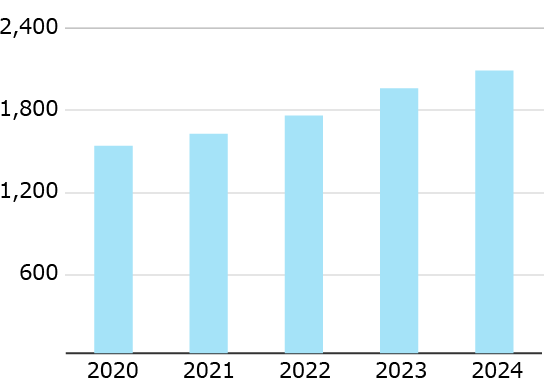

■Total

stockholders' equity

■Total

liabilities

■Interest-bearing

debt

(Millions of yen)

| |

2020 |

2021 |

2022 |

2023 |

2024 |

| Net sales

|

¥1,014,741 |

¥1,052,972 |

¥1,077,009 |

¥1,175,562 |

¥1,244,488 |

| Gross profit

|

353,618 |

367,855 |

343,607 |

379,046 |

405,255 |

| Operating

income |

17,438 |

18,359 |

22,032 |

41,962 |

51,873 |

| Ordinary

income |

19,734 |

21,382 |

26,127 |

45,526 |

56,305 |

Profit

attributable to

owners of parent

|

6,956 |

10,378 |

12,368 |

30,168 |

36,015 |

| Depreciation

and amortization |

37,420 |

38,997 |

39,436 |

40,318 |

41,863 |

| Capital

investment |

38,056 |

43,625 |

41,447 |

44,644 |

52,050 |

| Total

stockholders' equity |

330,486 |

342,574 |

363,738 |

400,137 |

412,150 |

| Total

liabilities |

352,060 |

375,135 |

350,133 |

355,902 |

404,618 |

|

Interest-bearing debt |

78,092 |

104,074 |

92,277 |

85,916 |

106,575 |

-

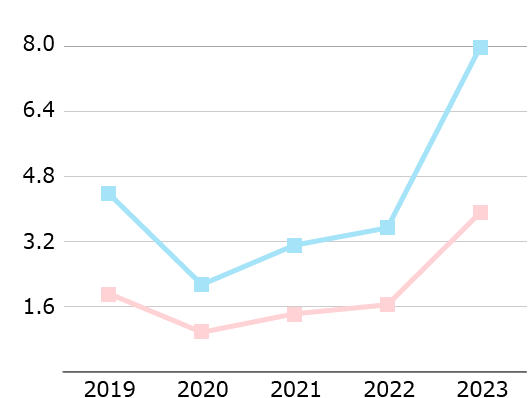

■Gross

profit margin

■Operating

margin

■Ordinary

income margin

■Net income

margin

(%)

-

■Return on

equity (ROE)

■Return on

assets (ROA)

(%)

-

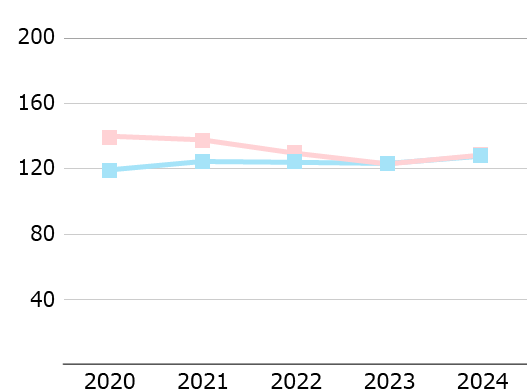

■Current

ratio

■Ratio of

total fixed assets to total stockholders' equity

(%)

-

■Equity

ratio

■Debt-to-equity

ratio

(%)

| |

2020 |

2021 |

2022 |

2023 |

2024 |

| Gross profit

margin |

34.85% |

34.93% |

31.90% |

32.24% |

32.56% |

| Operating

margin |

1.72 |

1.74 |

2.05 |

3.57 |

4.17 |

| Ordinary

income margin |

1.94 |

2.03 |

2.43 |

3.87 |

4.52 |

| Net income

margin |

0.69 |

0.99 |

1.15 |

2.57 |

2.89 |

| Return on

equity (ROE) (1) |

2.12 |

3.08 |

3.50 |

7.90 |

8.87 |

| Return on

assets (ROA) (2) |

0.96 |

1.41 |

1.63 |

3.87 |

4.32 |

| Current ratio

|

118.11 |

123.25 |

122.74 |

122.07 |

126.47 |

Ratio of total

fixed assets to

total stockholders'

equity |

138.64 |

136.43 |

128.31 |

121.77 |

127.07 |

| Equity ratio

|

46.26 |

45.23 |

47.98 |

49.89 |

47.64 |

| Debt-to-equity

ratio (3) |

24.82 |

32.94 |

29.15 |

25.43 |

31.03 |

-

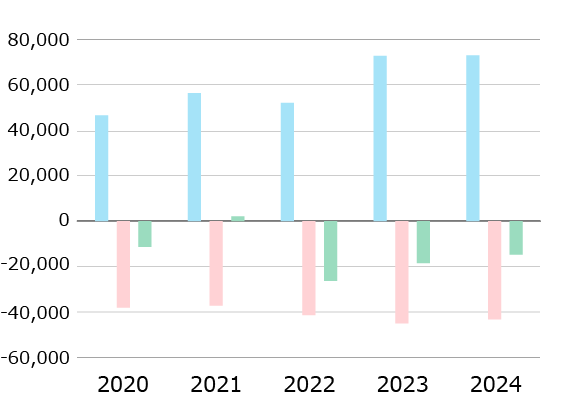

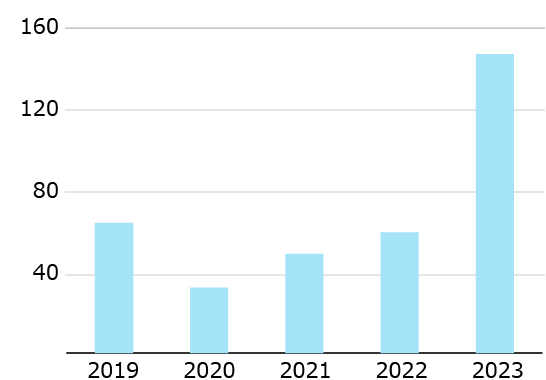

■Net cash

provided by operating activities

■Net cash

used in investing activities

■Net cash

provided by (used in) financing activities

(Millions of yen)

-

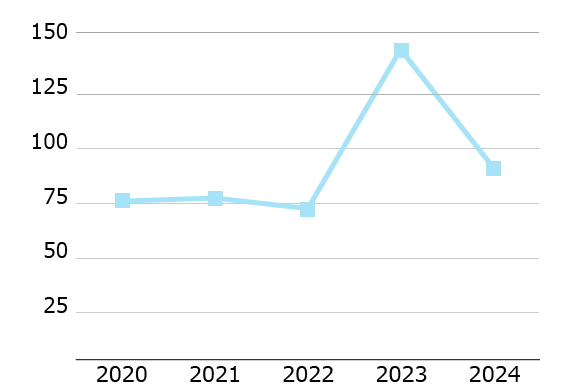

■Interest

coverage ratio

(Times)

-

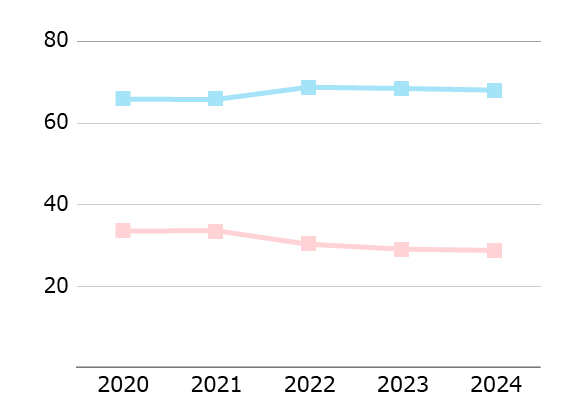

■Ratio of

cost of sales to net sales

■Ratio of

selling, general and

administrative

expenses to net sales

(%)

-

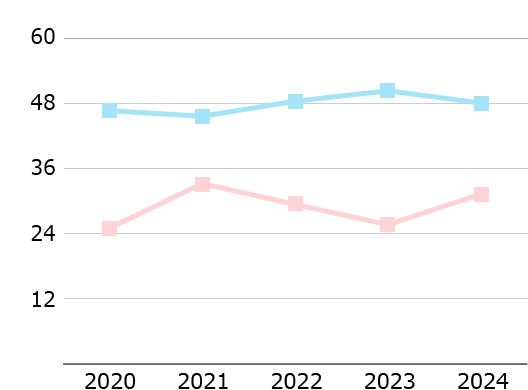

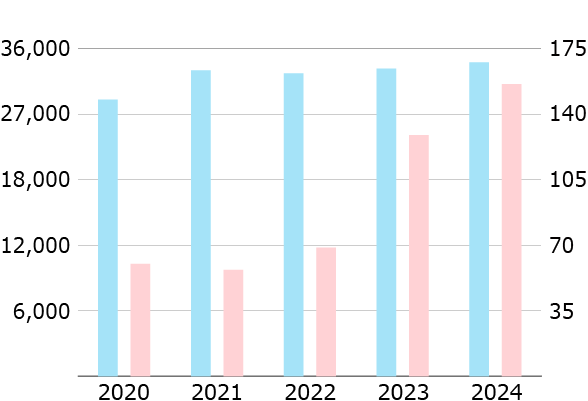

■Number of

employees

■Oparating

income per employee

(No.of

employees)

(Ten thouthand

of yen)

(Millions of yen,

Yen, Times, %, No.of employees)

| |

2020 |

2021 |

2022 |

2023 |

2024 |

| Net cash

provided by operating

| 47,157 |

57,071 |

52,773 |

73,689 |

73,974 |

| Net cash used

in investing activities |

-38,623 |

-37,790 |

-41,984 |

-45,659 |

-43,902 |

| Net cash

provided by (used in) financing

activities |

-11,585 |

2,070 |

-26,695 |

-18,834 |

-15,038 |

| Interest

coverage ratio (Times)(*) |

72.30 |

73.69 |

68.90 |

141.45 |

87.52 |

| Ratio of cost

of sales to net sales(%) |

65.2% |

65.1% |

68.1% |

67.8% |

67.4% |

| Ratio of

selling, general and administrative

expenses to net sales(%) |

33.1% |

33.2% |

29.9% |

28.7% |

28.4% |

| Number of

employees |

29,243 |

32,527 |

32,210 |

32,725 |

33,393 |

| Oparating

income per employee(Yen) |

596,331 |

564,440 |

684,041 |

1,282,263 |

1,553,435 |

-

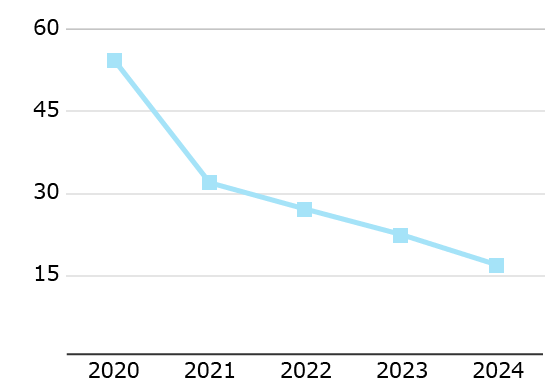

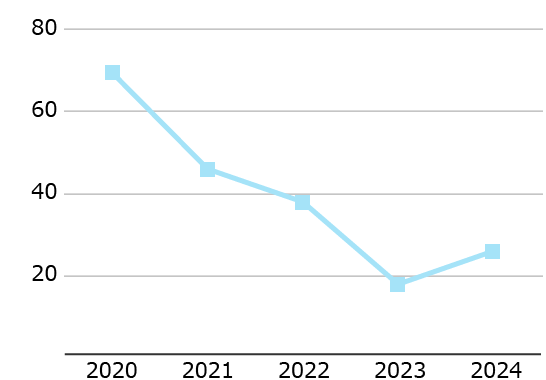

■Price-earnings

ratio

(Times)

-

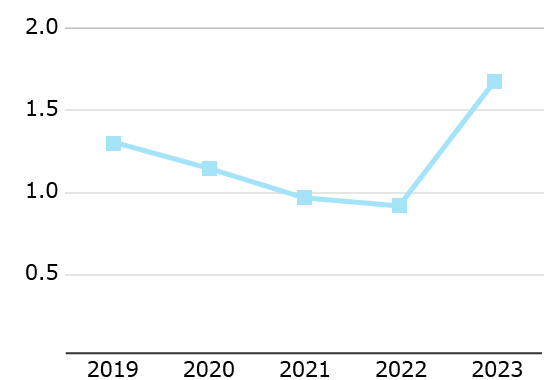

■Price-book

value ratio

(Times)

-

■Net income

per share

(Yen)

-

■Net assets

per share

(Yen)

-

■Dividend

payout ratio

(%)

| |

2020 |

2021 |

2022 |

2023 |

2024 |

| Price-earnings

ratio (Times) |

53.87 |

31.44 |

26.63 |

22.00 |

16.48 |

| Price-book

value ratio (Times) |

1.13 |

0.95 |

0.90 |

1.66 |

1.42 |

| Net income per

share(Yen) |

¥32.00 |

¥48.60 |

¥59.10 |

¥146.19 |

¥178.58 |

| Net assets per

share(Yen) |

1,520.24 |

1,609.57 |

1,743.42 |

1,942.85 |

2,072.34 |

| Dividend

payout ratio(%) |

68.75% |

45.27% |

37.22% |

17.10% |

25.20% |

|

|

|

|